Looking for stay at home mom money saving tips? Whether you’re a stay at home mom or a stay at home working mom, you’ve definitely thought about how you can make or save money. I mean let’s face it, this economy has everyone in a tailspin right now. Groceries are more expensive than ever, electric has gone up, gas is higher than it’s been in ages, and the list goes on.

So if you’re a stay at home working mom (or aspiring to be), then you’ve definitely thought about how you can make money online. How quickly you can make that happen? How much you need to make to contribute your family’s financial success? All questions you might be asking yourself.

But what about the money we save? If we save money on the things we’re already buying for our family, like groceries, diapers, kids activities, and even self-care for ourselves as moms, isn’t that kind of like making money? I think so! Anything saved is money in your pocket.

So, let’s talk about some stay at home (working) mom money saving tips that I’ve found throughout my (at the time of writing this) 5 year stay at home working mom journey.

Related Article: Work From Home Jobs for Moms: How to Find and Succeed in the Right Opportunity

AFFILIATE DISCLAIMER: I SOMETIMES LINK TO PRODUCTS AND SERVICES TO HELP COVER THE COSTS OF RUNNING THIS BLOG. THERE’S NO EXTRA COST TO YOU – AND I ONLY RECOMMEND PRODUCTS THAT I’VE BOTH USED PERSONALLY AND THINK ARE QUALITY PRODUCTS THAT HELP WITH EFFICIENCY. PLEASE READ MY AFFILIATE DISCLOSURE FOR MORE INFORMATION. THANKS FOR YOUR SUPPORT!

Table of Contents

- How to Save Money as a Stay at Home Working Mom

- Stay at Home Mom Budget Tips:

- Stay at Home Mom Budget:

- 10 Stay at Home Mom Apps:

- Kroger Groceries Plus Fuel Points

- Buy in Bulk to Save Even More

- Open a High-Yield savings account

- Use Credit Cards with Cash Back Rewards

- Stay at Home Mom Money Saving Tips

How to Save Money as a Stay at Home Working Mom

There are many stay at home mom money saving tips that I can give you. But some of the easiest ways are money-saving apps. You can also open a high-yield savings account to make interest each month on the money you’ve saved. Plus, these accounts accrue compound interest for even more money in your pocket.

And we can’t forget about cash back rewards credit cards, which are a great way to get some extra cash. As long as you always pay off your balance each month. Or even travel rewards credit cards. Think it’s too expensive to go on vacation right now? Nope! You definitely can! And I’ll show you how exactly we do it.

And of course, bulk stores like Sam’s Club or Costco can be a great way to save on the items you use regularly. I prefer couponing, and I save more using coupon apps and rebate apps. But if you don’t have the time to do so, bulk stores are a great second option. They’re slightly higher than coupon prices, but still better than paying full price at normal grocery stores.

So let’s go through this round up of money-saving tips that I’ve found over the past 5 years of being a stay at home working mom. We’ll start with the importance of a budget and some free resources to get you started.

Stay at Home Mom Budget Tips:

Creating a budget is a crucial step in managing your finances effectively. It allows you to track your income, set spending limits, and prioritize your expenses. By having a clear budget in place, you can identify areas where you can cut back, save more, and achieve your financial goals.

Basically, if you don’t know where your money is going, you can’t figure out where to start when trying to lower your bills. You have to know where each little bit is going. Including the money that’s going into your savings, things you pay annually or every six months, and your general bills.

Stay at Home Mom Budget:

Three apps to create your own stay at home mom budget. Keep your family and your finances on track easily. Create better ways to track your spending, keep everything in check, and make sure you’re saving. Plus, the best way to prepare for future expenses without the stress of not having enough.

- Mint: Mint is a popular free budgeting app that helps you track your income, expenses, and savings. It provides visual representations of your spending habits and offers personalized suggestions for saving money.

- EveryDollar: EveryDollar is a user-friendly budgeting app that follows the zero-based budgeting approach. It allows you to assign every dollar a purpose and track your spending accordingly.

- GoodBudget: If you follow anything Dave Ramsey, then you know about the envelope method. As for me, I don’t like using cash that much. So I use the GoodBudget app. It’s the envelope method, but digital. You can track your expenses as you go. This one gives 10 envelopes for free, and it doesn’t have as many of the bells and whistles as the others in this list. It’s just one that I’ve been using for awhile. I use the free version, and it works. You get 10 free envelopes, but you can always combine bills into one envelope. For example, I have all of our tv streaming services and internet in one envelope. That way I save on envelopes, and I don’t have to pay for extra.

Related Article: Work From Home Jobs for Moms: How to Find and Succeed in the Right Opportunity

10 Stay at Home Mom Apps:

Some of these apps take just a little time and some no time at all. So let’s start with the apps that use the receipts from the things you’re already buying. You don’t have to plan anything extra. You’re just getting points and cash back on the things you’re already buying.

So here are the 10 stay at home mom money saving tips and apps for cash back and coupon savings. These are apps that I personally use and recommend.

1. BrandClub:

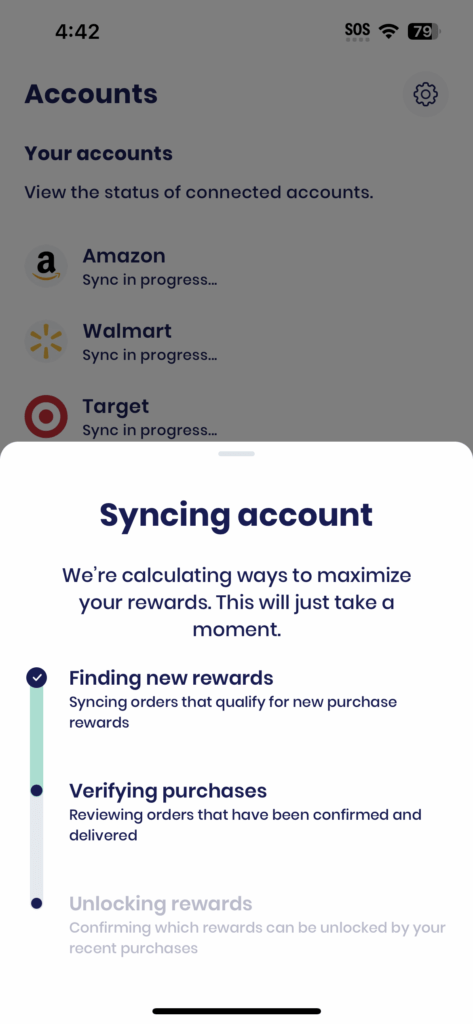

This one is new for me! I added the app to my phone and started getting deals back instantly for things that had purchased online a few days ago. If you use this link, you’ll get and extra $12 to get you started.

So how does it work? Well, BrandClub offers exclusive deals and discounts on a wide range of products, but the cool thing about it is that it’s a loyalty money-saving app. So if you’re loyal to any name brands, you’ll get more cash back for it. Connect the stores you shop at regularly. I connected Kroger, Amazon, Target, Best Buy, Home Depot, Sephora, and Walmart, so I can get cash back from those specific stores.

For example, if there’s a cash back offer for Kroger all I have to do is get groceries at Kroger like normal. Then my cash back will be moved from my view balance to my cash out balance. I can cash out at anytime, but they take $1 each time I cash out. So I like to let it build up just a little before I cash out.

I always get cash back at Kroger for any of the name brands that I buy. I just go into the BrandClub app, hit the plus sign at the bottom, and it’ll sync my purchases. It’s so easy.

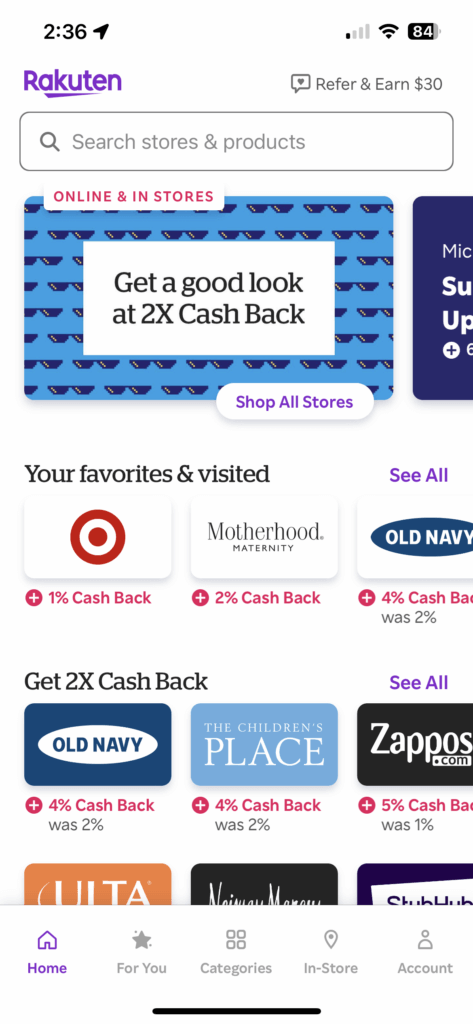

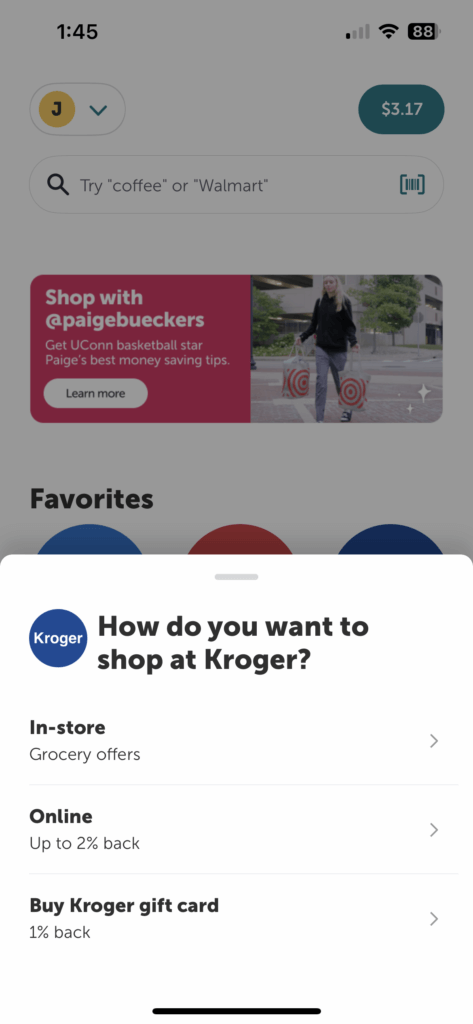

2. Rakuten:

Rakuten (formerly known as Ebates) provides cashback and coupons for online shopping, allowing you to earn money while making purchases.

How does it work? Download the Rakuten app. Shop and spend $30 and you’ll get a $30 cash back bonus. Here’s how it works:

- Just shop by going through the Rakuten app

- Find the store you want to shop at while in the app

- Click on that store, and you’ll see the percentage of cash back offered

- Once on the site of the store you selected, you can sign in if you’re a returning customer to get any rewards or bonuses offered by that store as well.

- Then shop, pay, and you’re all set.

- You’ll get notified of your cash back from Rakuten. Once you get that notification, your cash back will be in your Cash Back Balance.

- You can request to receive your cash back by Check or PayPal under the setting tab in Rakuten.

- Perfect for Christmas shopping when you’re spending more money than usual.

You can also add Rakuten to your Chrome browser for desktop shopping, and Rakuten will automatically work while you’re shopping. Simply visit your favorite sites, and Rakuten will search for better deals and cash back options for you.

4. Upside App:

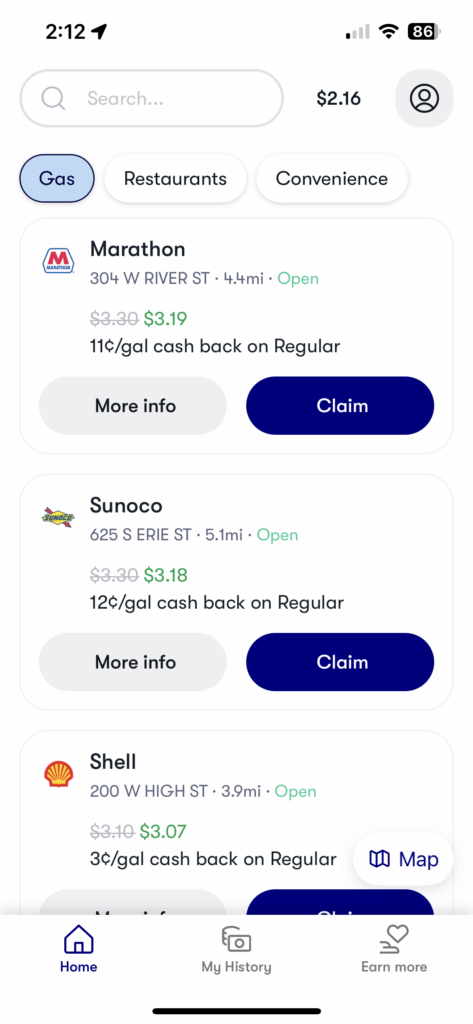

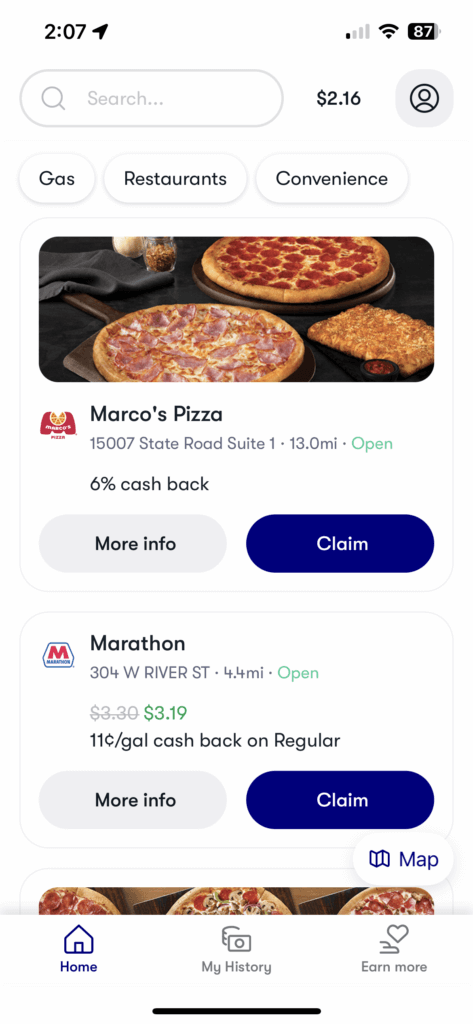

Upside is a handy app that offers cashback on gas purchases, helping you save money on fuel expenses. Right now, with my link (or use code KDCP92) you’ll get $11.11 the first time you use the app. I love this one because you need gas. It’s something you’re buying anyway, so might as well save some money while you’re doing it.

All you have to do is download the Upside app, add your credit card that you’ll pay for gas with, and then start saving. Each time you need gas, open the app and see nearby gas stations with cash back options. I generally find 10% cash back, but that could be different in your area.

You’ll click claim for the offer you want, and it’ll give you about 30 minutes to use the offer. Once you’ve gotten your gas and paid using your card on file in the Upside app, you simply click paid. Your cash back will be in your Upside app within a few days.

You can cash out directly to your bank account at any time. Or you can get gift cards starting at $10.

I also have been able to combine this with the Kroger fuel rewards when I use it at Shell. Available at select Shell stations, but you can only use $.10 at a time. You can’t choose a higher amount off like at the Kroger Fuel Stations.

Related Article: How I Quit My Corporate Job and Became a Work from Home Mom

Plus, now Upside is adding cash back on other items like restaurants. My lifetime amount so far is $73.74, and I’ve been using the app for about a year.

But I stay home with my kids, so I don’t drive as often as most might. And I also use Kroger fuel points from our grocery orders as well.

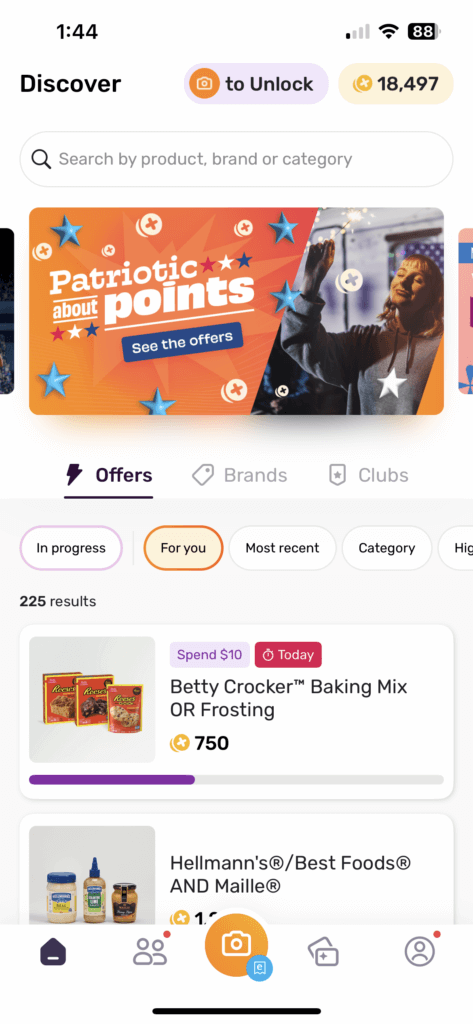

5. Fetch

With this link, you’ll get 100 points to get you started. And Fetch is so easy to get started with.

Simply download the app, and start scanning receipts. All of your receipts. You scan each receipt and automatically get 25 points on everything.

Some receipts will have bonus points for certain brands. As an example, I could go to the gas station and get my husband a Mountain Dew and bag of Doritos. It might have a bonus for both of those brands. I could walk away with 300 points from one purchase. As your points add up, you can redeem them for gift cards to many different brands including food, shopping, and more. Gift cards are great to have on hand for quick gifts as well.

6. Ibotta

With this link, you’ll get $5 to get you started with Ibotta. So how does it work? Ibotta offers cashback on groceries, online shopping, and even restaurant purchases, making it an excellent app for saving money on a variety of items.

My only issue with this app, and it really isn’t Ibotta’s fault. But I like to use grocery pick up at Kroger. Once I get my groceries, they don’t give me a receipt to scan into Ibotta, so I can’t get my points. They have since added an option for online offers. It’s always a set 2% cash back, which is something but it’s a lot less than what you would get with the normal offers.

But if you don’t use grocery pick up a lot and go in-store, you can really rack up the cash back with Ibotta. And if you shop at Walmart, you can use the grocery pick up option and get cash back automatically put into your Ibotta account.

So, sometimes I put in an order to Kroger for the bulk of my order and then just go inside for my Ibotta items. Or if I have all of my kids with me or it’s just gross outside, I put my Ibotta items in a separate order to Walmart. That

You can get cash back in the form of gift cards. Or, you can also link it to your bank account for cash, instead of gift cards. I use the cash option. That way I can put it back into our account and our GoodBudget app as added income.

This is by far my biggest money make in the grocery coupons and rebate apps category. My next highest money-maker is my travel rewards credit card, cash back credit card, and the highest is our high yield savings account.

7. Amazon Subscribe and Save:

I’m sure you’re familiar with Amazon’s Subscribe and Save. But, if you’re a mom with babies and still use diapers or pull ups, this can be huge.

So, I used to always get Target brand diapers (I also like Meijer if you have one in your area), but my youngest gets a rash from anything but Pampers. So I started ordering those from Amazon. They tend to either match or beat Target with deals.

They even offer deals to match Target’s Buy $100 worth of diapers and get a $20 gift card. But Amazon just gives you the $20 off, instead of a gift card. We also use Subscribe and Save for many other household items that we use regularly like toilet paper, paper plates, dishwasher detergent, and Mrs. Meyer’s cleaning products.

If you don’t have Amazon Prime already, get your free 30 trial of Amazon Prime. Having Amazon Prime gives us access to Prime Video as well. So this could replace one of your other streaming apps if you’re looking to save elsewhere.

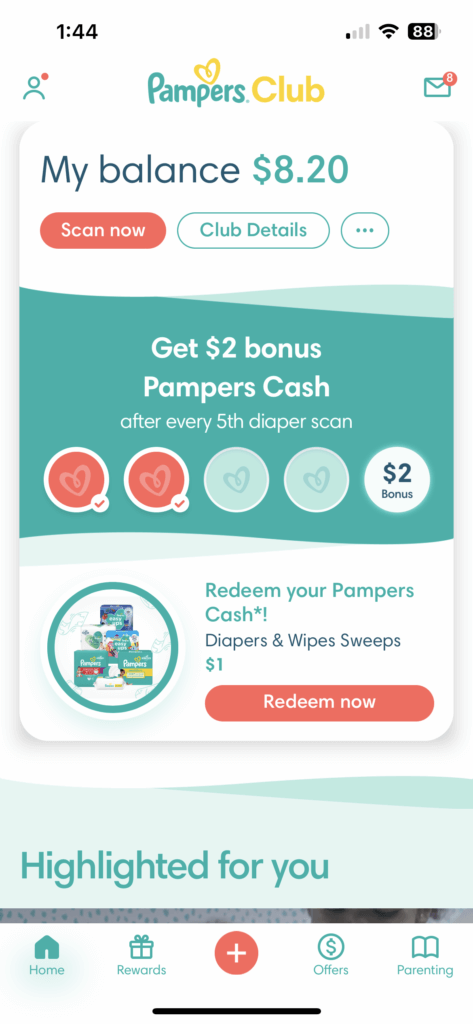

8. Pampers Rewards App:

Specifically designed for parents, the Pampers Rewards App allows you to accumulate points by purchasing Pampers products, which can be redeemed for various rewards. Like I said above, I used to be partial to Target brand diapers but I had to switch to Pampers only for my youngest. This app let’s me scan the diapers and wipes to get cash back and coupons for more diapers.

Not a huge money-maker, but it does give you extra coupons and such for the diapers you’re already buying.

The diapers are easy to scan in. The wipes, you have to enter the code manually every time. It’s annoying and you get very little for the wipes. Diapers give you much higher rewards. So maybe pick and choose what you add.

9. Target Circle App:

Get the Target Circle app for discounts on groceries, baby items, and more. Plus, you can pair your Target Circle savings with Ibotta and BrandClub. Or buy online and pair it with Rakuten. And don’t forget to scan your receipt into Fetch!

10. SwagBucks:

Swagbucks is another rebate app for groceries. You can submit your receipt to swagbucks for cash back on the items you’re already buying. Just this month, I was able to get 1,000 Swagbucks back for buying Children’s Claritin Chewables. That means I got back $10. And I hit my 25,000 Swagbucks goals. So I could get a $25 Buffalo Wild Wings gift card. But when I went to get it, it was on promotion, so I actually only had to use 2,200 Swagbucks to get my $25 gift card. Win!

Using my link above, means you’ll get a bonus 300 SB this month! Just earn 300 points this month, and you’ll get a 300 SB bonus on top – that’s 600 SB for the gift card of your choice!! And 600 points is worth $6 in the app. You can also get discounts on gift cards to make your points go even further. Like I mentioned above with the BWW gift card.

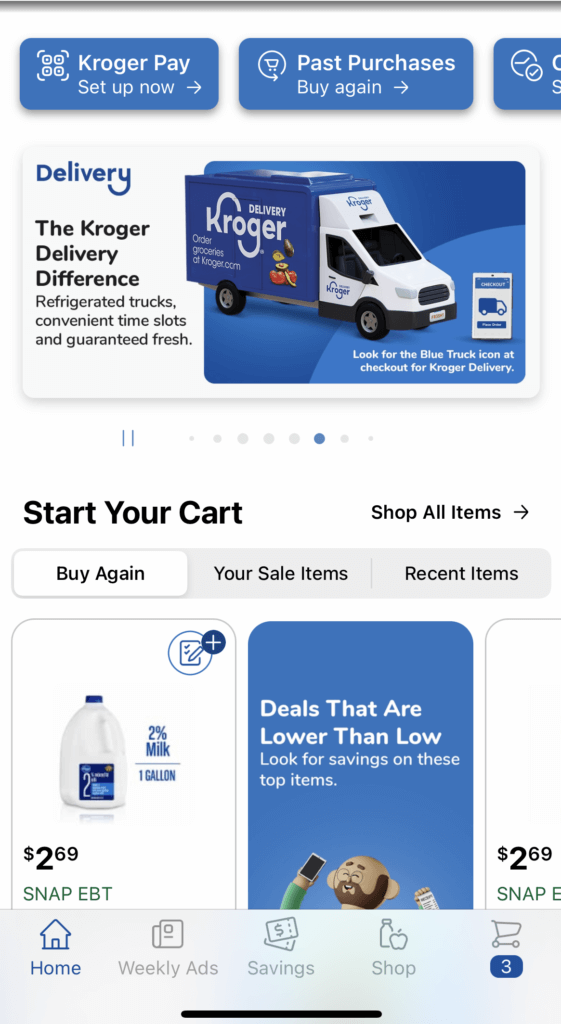

Kroger Groceries Plus Fuel Points

So there are many places to get groceries, and you’ll choose what works best for you. For our family, we’re pretty loyal to Kroger for a few reasons. Number one their produce just seems to be better, at least in our area. Number two, the fuel points.

Using the Kroger card, buying mostly Kroger brands, and getting rewards points for fuel makes it the best option for us. I’ve tried Walmart and Meijer, but Kroger is our favorite.

Plus, you can use your fuel point rewards at any Shell station. It says any participating Shell station, but I haven’t found one that doesn’t take the rewards points. At least not yet. But anywhere you can’t get the fuel points to work, just use Upside! We have a local Shell station, so I actually combine and use both when I can.

Just scan your Kroger card to get use your fuel points to lower the price per gallon. Plus, claim the Upside offer, and you’ll get cash back in Upside on top of your discount from Kroger. It’s a double win!

I’m not affiliate with Kroger in any way, so I don’t have any sign-up bonuses with this one. However, they run offers regularly. So I would just make sure to look for any special offers for new sign ups if you decide to try this one out.

You can usually get $15 off of $75 for first time grocery pick up orders in the app. They also offer 4X Fuel points rewards on gift cards. And you can also sign up for Boost for even more savings. I haven’t tried Boost at the time of writing this, but they are offering a free 30 day trial right now. I’ll update this article once I try it out.

Buy in Bulk to Save Even More

My favorite bulk stores are Costco and Sam’s Club. These warehouse clubs offer bulk purchasing at discounted prices, helping you save money on groceries, household essentials, and more. You have to pay for a membership, but Sam’s Club offers 50% off membership quite regularly.

Open a High-Yield savings account

Marcus by Goldman Sachs is an online banking platform that offers high yield savings accounts. With competitive interest rates, Marcus provides an opportunity to grow your savings faster. Although other institutions may occasionally offer higher yields, Marcus consistently provides one of the highest average yields, ensuring that your money works harder for you in the long run. And I like that they let you get access to your money the same day. As long as I request a transfer to my local bank by 12 PM Eastern, the money will be in my local bank account the same day.

That’s why I picked this particular one. But be sure to do your research and pick the one that best suits your needs.

Plus, using my link will give you an extra referral bonus at the time of writing this it’s an extra 1% added to your interest rate for three months(at the time of writing this, the regular rate is 4.15% APY- but interest rates can change at any time). They offer no fees and no minimum deposit.

Use Credit Cards with Cash Back Rewards

If you’re trying to save money, credit cards aren’t the best way to do so. But, if you have a budget and you know you can stick to it then the cash back rewards can be a great way to save some extra money. There are many credit cards you can get with cash back rewards or even travel miles as rewards. Pick and choose what works best for you and your family.

My family uses Capital One Quicksilver Rewards card for 1.5% cash back on all purchases. Plus, right now they’re offering a one-time $200 cash back bonus when you sign up, get approved, and spend $500 on purchases within 3 months from account opening.

And I also have the Capital One Venture Card for travel rewards. I signed up when they offered a bonus of 75,000 miles and an extra $250 travel credit. I got all of that just by spending $4,000 in the first three months. I recommend waiting for a bonus to sign up. It’s well worth it to get the perks. This particular card has a yearly fee of $95. Which is worth it for what you get, but you can also downgrade before the year is up to skip that yearly fee. You would lose your 2x points on every dollar spent, as well as the other perks.

I follow a travel rewards influencers online to learn how to best use travel points. If you want to learn to travel for free on points, you can check them out also: The Maxwells Travel, Travel Freely (has an app to track your credit cards and rewards point options), and Travel Mom Squad. All of them offer blogs to learn for free too!

We put our monthly bills on our credit cards and auto pay them from our bank a few days later. It makes it easy to get more credit card rewards points, but also not spending money we don’t have. You definitely don’t want to pay the high interest charged by credit cards. You can get your own Capital One Venture Card and earn extra points and rewards miles for free vacations.

I also downloaded this audiobook off Amazon for extra travel points learning: The JGOOT Way of Travel: When You Just Get Out Of Town… You can travel more often.

Stay at Home Mom Money Saving Tips

As a stay-at-home working mom, saving money and managing your finances effectively is crucial. By utilizing money-saving apps like Upside, BrandClub, and Rakuten you can add money back into your budget.

And practicing budgeting with free resources like GoodBudget or EveryDollar, exploring high yield savings options like Marcus by Goldman Sachs, and using cash back credit cards you can make significant strides in achieving your financial goals.

Ultimately, you’re securing a brighter future for your family. So let me know in the comments. Which of these stay at home mom money saving tips are you going to start implementing today?

Related Article: Work From Home Jobs for Moms: How to Find and Succeed in the Right Opportunity

And for my favorite couponing influencers, check out these social pages:

- For great Kroger grocery deals – Shopping with Shana

- Amazon deals, Couponing at Dollar General, Kroger, Walgreens and more – Online Deals with Megan

- Target, CVS, Walgreens, Amazon, and more couponing – Coupon with Ashely B

- Tons of Walgreens deals and low out of pocket deals, like $5 challenge or $10 challenge. She also does deals for DG and CVS – Alysia LeMaster

+ show Comments

- Hide Comments

add a comment